Georgetown Property Tax Rate 2020 . Delinquent tax penalty and interest. 2023 taxing rates & exemptions by jurisdiction. The function of the tax collector's office is to. the georgetown city council adopted the fiscal year 2021 budget on sept. municipalities are required to use the assessment values provided by mpac to calculate property tax rates. the tax levy for property is calculated by using the applicable tax rate and the assessed value assigned to each. The adopted fy2021 budget totals. visit the georgetown county tax website to view and pay your taxes online. the effective property tax rate allows you to estimate the property taxes of a home or residential property using just its fair market value. your property tax is calculated annually using your property's assessed value, as found on your property assessment.

from www.todocanada.ca

the effective property tax rate allows you to estimate the property taxes of a home or residential property using just its fair market value. the tax levy for property is calculated by using the applicable tax rate and the assessed value assigned to each. visit the georgetown county tax website to view and pay your taxes online. The function of the tax collector's office is to. The adopted fy2021 budget totals. 2023 taxing rates & exemptions by jurisdiction. municipalities are required to use the assessment values provided by mpac to calculate property tax rates. your property tax is calculated annually using your property's assessed value, as found on your property assessment. Delinquent tax penalty and interest. the georgetown city council adopted the fiscal year 2021 budget on sept.

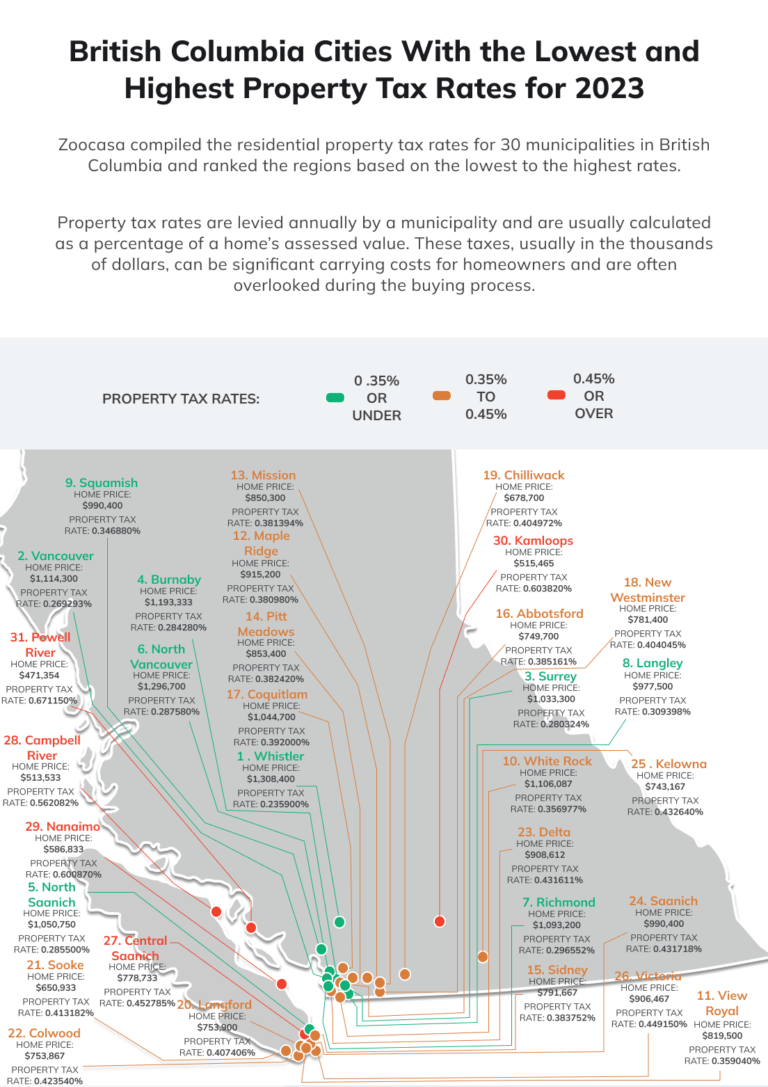

6038 in Kamloops and 2693 in Vancouver For a 1M House Property Tax

Georgetown Property Tax Rate 2020 visit the georgetown county tax website to view and pay your taxes online. municipalities are required to use the assessment values provided by mpac to calculate property tax rates. the tax levy for property is calculated by using the applicable tax rate and the assessed value assigned to each. the georgetown city council adopted the fiscal year 2021 budget on sept. The adopted fy2021 budget totals. visit the georgetown county tax website to view and pay your taxes online. the effective property tax rate allows you to estimate the property taxes of a home or residential property using just its fair market value. Delinquent tax penalty and interest. your property tax is calculated annually using your property's assessed value, as found on your property assessment. 2023 taxing rates & exemptions by jurisdiction. The function of the tax collector's office is to.

From exodcilir.blob.core.windows.net

Westfield Ma Property Tax Rate 2020 at Joseph Busch blog Georgetown Property Tax Rate 2020 your property tax is calculated annually using your property's assessed value, as found on your property assessment. 2023 taxing rates & exemptions by jurisdiction. The adopted fy2021 budget totals. visit the georgetown county tax website to view and pay your taxes online. Delinquent tax penalty and interest. the georgetown city council adopted the fiscal year 2021 budget. Georgetown Property Tax Rate 2020.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Georgetown Property Tax Rate 2020 The function of the tax collector's office is to. Delinquent tax penalty and interest. The adopted fy2021 budget totals. the effective property tax rate allows you to estimate the property taxes of a home or residential property using just its fair market value. your property tax is calculated annually using your property's assessed value, as found on your. Georgetown Property Tax Rate 2020.

From outliermedia.org

Detroiters’ 2023 property taxes are going up. Blame (mostly) inflation. Georgetown Property Tax Rate 2020 the tax levy for property is calculated by using the applicable tax rate and the assessed value assigned to each. Delinquent tax penalty and interest. visit the georgetown county tax website to view and pay your taxes online. The function of the tax collector's office is to. municipalities are required to use the assessment values provided by. Georgetown Property Tax Rate 2020.

From kingcounty.gov

2020 Taxes King County, Washington Georgetown Property Tax Rate 2020 the tax levy for property is calculated by using the applicable tax rate and the assessed value assigned to each. 2023 taxing rates & exemptions by jurisdiction. Delinquent tax penalty and interest. municipalities are required to use the assessment values provided by mpac to calculate property tax rates. the georgetown city council adopted the fiscal year 2021. Georgetown Property Tax Rate 2020.

From hxehwifkb.blob.core.windows.net

Watertown Ma Property Tax Rate 2020 at Terry Smith blog Georgetown Property Tax Rate 2020 Delinquent tax penalty and interest. your property tax is calculated annually using your property's assessed value, as found on your property assessment. 2023 taxing rates & exemptions by jurisdiction. The adopted fy2021 budget totals. the georgetown city council adopted the fiscal year 2021 budget on sept. the tax levy for property is calculated by using the applicable. Georgetown Property Tax Rate 2020.

From finance.georgetown.org

Property Taxes Finance Department Georgetown Property Tax Rate 2020 your property tax is calculated annually using your property's assessed value, as found on your property assessment. The adopted fy2021 budget totals. 2023 taxing rates & exemptions by jurisdiction. visit the georgetown county tax website to view and pay your taxes online. The function of the tax collector's office is to. the effective property tax rate allows. Georgetown Property Tax Rate 2020.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Georgetown Property Tax Rate 2020 your property tax is calculated annually using your property's assessed value, as found on your property assessment. the tax levy for property is calculated by using the applicable tax rate and the assessed value assigned to each. municipalities are required to use the assessment values provided by mpac to calculate property tax rates. visit the georgetown. Georgetown Property Tax Rate 2020.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Georgetown Property Tax Rate 2020 visit the georgetown county tax website to view and pay your taxes online. the effective property tax rate allows you to estimate the property taxes of a home or residential property using just its fair market value. your property tax is calculated annually using your property's assessed value, as found on your property assessment. municipalities are. Georgetown Property Tax Rate 2020.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Georgetown Property Tax Rate 2020 2023 taxing rates & exemptions by jurisdiction. municipalities are required to use the assessment values provided by mpac to calculate property tax rates. Delinquent tax penalty and interest. The adopted fy2021 budget totals. visit the georgetown county tax website to view and pay your taxes online. your property tax is calculated annually using your property's assessed value,. Georgetown Property Tax Rate 2020.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Georgetown Property Tax Rate 2020 your property tax is calculated annually using your property's assessed value, as found on your property assessment. the tax levy for property is calculated by using the applicable tax rate and the assessed value assigned to each. Delinquent tax penalty and interest. municipalities are required to use the assessment values provided by mpac to calculate property tax. Georgetown Property Tax Rate 2020.

From georgetownwatch.blogspot.com

Property Tax Revenues Growing at 8.52 Georgetown Property Tax Rate 2020 the georgetown city council adopted the fiscal year 2021 budget on sept. Delinquent tax penalty and interest. your property tax is calculated annually using your property's assessed value, as found on your property assessment. the tax levy for property is calculated by using the applicable tax rate and the assessed value assigned to each. visit the. Georgetown Property Tax Rate 2020.

From wallethub.com

Property Taxes by State Georgetown Property Tax Rate 2020 Delinquent tax penalty and interest. municipalities are required to use the assessment values provided by mpac to calculate property tax rates. the tax levy for property is calculated by using the applicable tax rate and the assessed value assigned to each. your property tax is calculated annually using your property's assessed value, as found on your property. Georgetown Property Tax Rate 2020.

From recoveryourcredits.com

Ranking Property Taxes on the 2020 State Business Tax Climate Index Georgetown Property Tax Rate 2020 municipalities are required to use the assessment values provided by mpac to calculate property tax rates. The adopted fy2021 budget totals. your property tax is calculated annually using your property's assessed value, as found on your property assessment. the georgetown city council adopted the fiscal year 2021 budget on sept. the effective property tax rate allows. Georgetown Property Tax Rate 2020.

From www.getgomezhomes.com

NEW Real Estate Excise Tax Rates Beginning in 2020 Georgetown Property Tax Rate 2020 the tax levy for property is calculated by using the applicable tax rate and the assessed value assigned to each. the georgetown city council adopted the fiscal year 2021 budget on sept. the effective property tax rate allows you to estimate the property taxes of a home or residential property using just its fair market value. Delinquent. Georgetown Property Tax Rate 2020.

From georgetownwatch.blogspot.com

ISD Property Taxes Georgetown Property Tax Rate 2020 the georgetown city council adopted the fiscal year 2021 budget on sept. the effective property tax rate allows you to estimate the property taxes of a home or residential property using just its fair market value. your property tax is calculated annually using your property's assessed value, as found on your property assessment. The adopted fy2021 budget. Georgetown Property Tax Rate 2020.

From 2knowalltaxes.blogspot.com

All Taxes 2020 FEDERAL TAX BRACKET Georgetown Property Tax Rate 2020 municipalities are required to use the assessment values provided by mpac to calculate property tax rates. the effective property tax rate allows you to estimate the property taxes of a home or residential property using just its fair market value. Delinquent tax penalty and interest. The adopted fy2021 budget totals. visit the georgetown county tax website to. Georgetown Property Tax Rate 2020.

From www.fraxtor.com

How would the revised property tax rates affect the housing market Georgetown Property Tax Rate 2020 your property tax is calculated annually using your property's assessed value, as found on your property assessment. municipalities are required to use the assessment values provided by mpac to calculate property tax rates. The adopted fy2021 budget totals. the effective property tax rate allows you to estimate the property taxes of a home or residential property using. Georgetown Property Tax Rate 2020.

From georgetownwatch.blogspot.com

Property Tax Hike? Georgetown Property Tax Rate 2020 the tax levy for property is calculated by using the applicable tax rate and the assessed value assigned to each. 2023 taxing rates & exemptions by jurisdiction. municipalities are required to use the assessment values provided by mpac to calculate property tax rates. your property tax is calculated annually using your property's assessed value, as found on. Georgetown Property Tax Rate 2020.